Market Pulse: Staples Take the Lead as Investors Seek Shelter in Defensive Plays

Rotation out of tech accelerates as inflation, tariffs, and policy risks drive demand for earnings stability

Markets opened the second half of the year with a significant shift in investor sentiment. While the S&P 500 and Nasdaq saw slight declines, the Dow managed to close in positive territory as capital flowed into consumer staples and industrial sectors. This movement occurred against a backdrop of renewed political headlines surrounding Trump’s "Big, Beautiful Bill," which cleared a key Senate vote. This bill sparked debate over tax relief, cuts to social programs, and which sectors might benefit, particularly defense. In the midst of this political landscape, Fed Chair Jerome Powell reaffirmed the central bank's "on hold" stance, citing tariffs as the primary reason interest rate cuts had not yet occurred. Amid this policy uncertainty, institutional investors began rotating towards more traditionally defensive stocks.

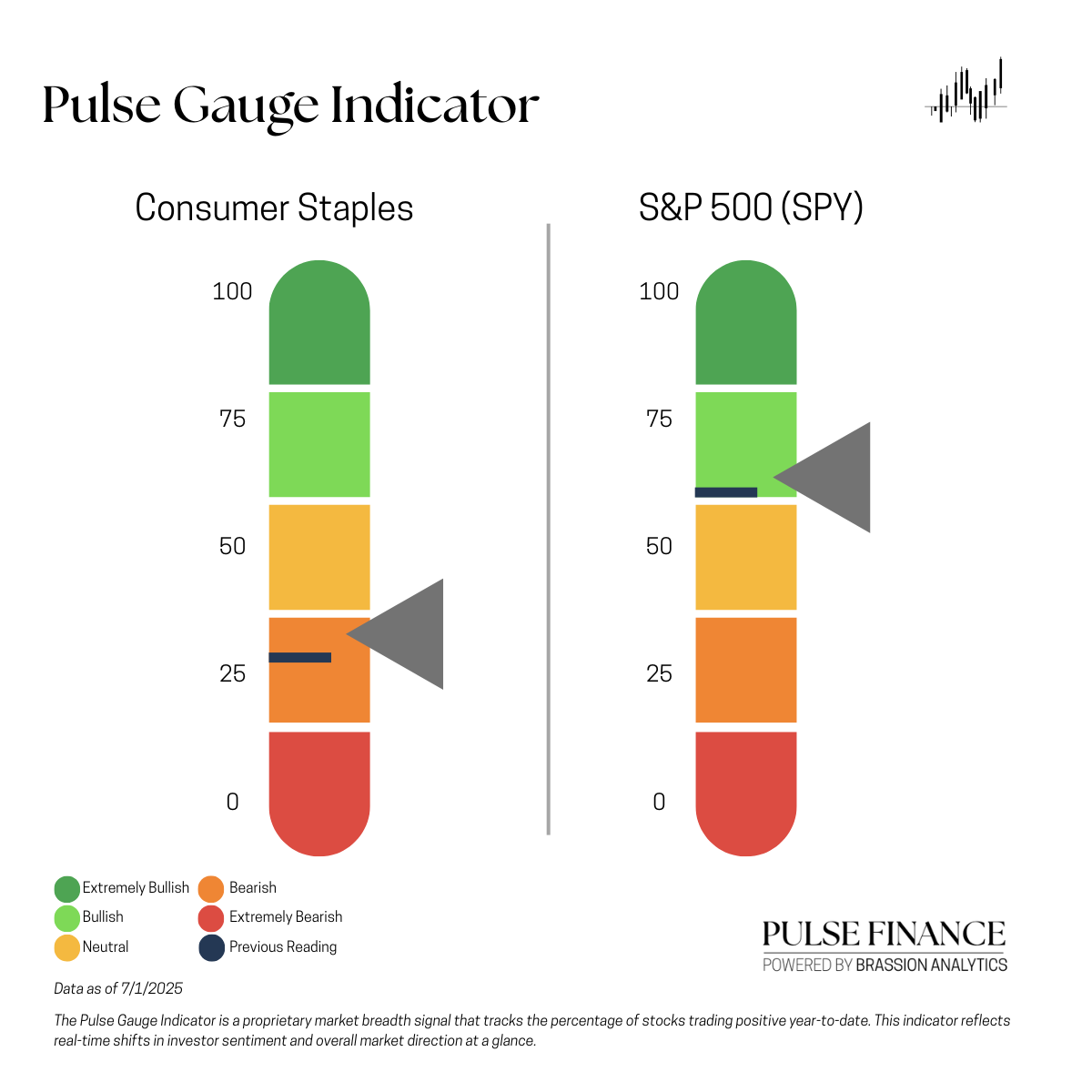

Our Pulse Gauge Indicator signaled a strong interest in the consumer staples sector, reaching its highest reading since launch as investors sought safety. Tootsie Roll Industries led this trend, continuing its modest but steady YTD advancement as investors gravitated towards established brands with low volatility. Archer-Daniels Midland also contributed to this YTD growth, recovering from significant losses in 2024 as agriculture related investments regained favor amid global tariff uncertainties. Mondelez saw an uptick as demand for snacks remained robust and rumors about potential acquisitions circulated. CVS Health, one of the standout performers of 2025, continued its YTD rally, bolstered by improving profit margins and stabilization across its pharmacy and insurance segments. Lastly, Corteva demonstrated ongoing strength, benefitting from its precision agriculture portfolio in a supply constrained environment. Collectively, these trends highlighted a broader investor shift toward stable earnings companies, as uncertainties regarding trade, policy, and economic growth continue to reshape market leadership.

Market Pulse Action:

S&P 500 decreased 0.11%

Nasdaq decreased 0.82%

Dow increased 0.91%

VIX increased 0.60%

Top Performers on a Rotation Day

What to take away:

Tootsie Roll Industries Inc. (TR): A rare outperformer during a down day, benefiting from increased interest in non-cyclical stocks as market volatility rose.

Archer-Daniels Midland (ADM): Jumped as investors rotated into agricultural and commodity linked stocks, driven by discussions surrounding tariffs and global food security concerns.

Mondelēz International Inc. (MDLZ): Experienced a solid gain, reflecting the continued resilience of snack demand. Additionally, it is rumored to be considering acquisitions in Latin America.

CVS Health Corp. (CVS): Extended its impressive YTD rally, fueled by optimism regarding margin improvement and stabilization of patient volumes. The healthcare giant has regained favor on Wall Street in 2025.

Corteva Inc (CTVA): Continued to rise as analysts have become increasingly optimistic about its biotech seed division, driven by a global surge in crop protection demand.

Year-to-Date Check-in

What to take away:

CVS Health Corp. (CVS): 2025 has marked a significant recovery for CVS, driven by cost discipline and strength in its insurance segment. Since it was first featured, the stock has increased by 12.69%.

Corteva Inc. (CTVA): The company’s advancements in precision agricultural technology and resilient sales of crop inputs are contributing to a multiquarter re-rating. Since it was first featured, the stock has increased by 5.42%.

Mondelēz International Inc. (MDLZ): After a disappointing performance in 2024, Mondelez has regained its footing. Expansion into emerging markets and strong pricing power are key factors in this recovery. Since it was first featured, the stock has increased by 3.77%.

Tootsie Roll Industries Inc. (TR): Often overlooked due to shifting consumer preferences, Tootsie Roll's defensive qualities have gained renewed attention in 2025.

Archer-Daniels Midland (ADM): The recovery has been slow but steady, with analysts suggesting that the worst may be over as grain prices and exports stabilize.

Looking Back: A Multi-Year Snapshot (2024–2021)

What to take away:

CVS Health Corp (CVS): After a two year decline, CVS’s projected bounce in 2025 signifies a meaningful turnaround. The current rally is helping to restore investor confidence and reverse past technical issues. However, over the last four years, CVS has underperformed its peers, with an average decrease of 5.22%.

Corteva Inc. (CTVA): Has experienced volatility but has generated a net positive performance over the past four years, driven by favorable macro food trends. During this period, CTVA has outperformed all its peers with an average increase of 11.83%.

Mondelēz International Inc. (MDLZ): Despite recent declines, Mondelez's long-term growth trajectory remains strong, supported by consistent growth in its core categories.

Tootsie Roll Industries Inc. (TR): This is a low beta, low volume stock, but its multiyear performance remains consistent with its peers.

Archer-Daniels Midland (ADM): Recent declines have been among the steepest in the sector, but ADM's historical resilience and exposure to global trade cycles keep it a focal point for investors.

Why This Matters

The early days of the second half of the year are sending a clear message: investors are preparing for increased volatility and disruptions driven by policy changes. With the tech sector taking a pause and macro risks such as tariffs, fiscal policy shifts, and concerns about global growth re-emerging, capital is rotating into sectors with more stable cash flows and defensible business models. The strength in consumer staples reflects not only a flight to safety but also a potential recalibration in investment strategy. Companies like CVS, Mondelez, and Corteva offer a combination of resilience, pricing power, and operational visibility that is becoming more appealing in a landscape where interest rate cuts are uncertain and fiscal risks are rising. As market leadership expands beyond the technology sector, staying diversified and monitoring shifts in sector momentum may prove vital in the coming quarters.