Market Pulse: Money Managers Backs International Plays as World ETFs Take the Lead

Institutional bets grow on international value and sector specific strength

Investors concluded last week with a cautious approach domestically while seeking opportunities abroad. A growing divergence is emerging between US equities and global markets, with select international ETFs showing impressive performance year to date. BlackRock CEO Larry Fink's comments have further fueled interest in international investing, as he emphasized undervalued opportunities in the UK and around the world, as well as a shift of institutional capital towards overseas markets. While the S&P 500 slows, global ETFs are gaining attention.

Our Pulse Gauge Indicator remains in extremely bullish territory for the World ETFs, even as the broader market remained cautious. Leading the international movement are funds from South Korea and Vietnam, which have experienced remarkable gains this year. Investors are favoring markets linked to semiconductor exports, manufacturing growth, and favorable demographic trends. Hong Kong and Kuwait are also outperforming the S&P 500 YTD, benefiting from valuation recoveries and regional fiscal stability. Even traditionally overlooked markets like the United Arab Emirates continue to attract investment, supported by oil revenues and diversification efforts. As global markets present compelling sectoral and macroeconomic stories, the rotation of capital into these ETFs seems to be more than just a short-term trend.

Market Pulse Action:

S&P 500 decreased 0.33%

Nasdaq decreased 0.22%

Dow decreased 0.63%

VIX increased 3.93%

Top Performers on a Global Rotation Day

What to take away:

Global X FDS MSCI Vietnam ETF (VNAM): Surged as investors continue to reallocate into frontier markets experiencing momentum from structural reforms. Vietnam's technology and manufacturing sectors are attracting institutional interest amidst China's economic slowdown.

iShares MSCI Hong Kong ETF (EWH): Has seen gains due to optimism surrounding the stabilization of the property sector and a rise in retail foot traffic. Despite ongoing political issues, capital inflows are beginning to return.

iShares MSCI UAE ETF (UAE): Has increased in value as oil related revenues support fiscal surpluses and infrastructure development. Investor confidence remains robust, with a double digit YTD performance.

iShares MSCI Kuwait ETF (KWT): Continued its steady performance as a dividend heavy regional play, benefiting from renewed interest in defensive international assets.

iShares MSCI South Korea ETF (EWY): Held steady after a strong run. South Korea's semiconductor driven rebound remains a key driver, and investors appear to be consolidating gains.

Year-to-Date Check-in

What to take away:

iShares MSCI South Korea ETF (EWY): Leads the pack in 2025, driven by a global rebound in chip demand and AI hardware exports, putting South Korea’s technology sector in the global spotlight. Since its initial mention, the ETF has climbed by 28.90%.

Global X FDS MSCI Vietnam ETF (VNAM): Is benefiting from a surge in manufacturing expansion and foreign direct investment, highlighting Vietnam’s growing role in the global supply chain shift. Since its initial mention, the ETF has risen by 14.88%.

iShares MSCI Hong Kong ETF (EWH): Rebound reflects increased confidence in Hong Kong’s role as a financial gateway, particularly as signs of economic stabilization emerge in mainland China.

iShares MSCI Kuwait ETF (KWT): Maintains a quiet but powerful YTD gain, reflecting investor appetite for yield and resilience amid market volatility. Since its initial mention, the ETF has climbed by 10.30%.

iShares MSCI UAE ETF (UAE): Continuing to stand out in the Middle East, this ETF is supported by strength in the oil sector and the diversification strategies outlined in the UAE Vision 2031 plan. This national strategy aims to transform the UAE into a global hub for economic activity, innovation, and sustainability by reducing dependence on oil, investing in human capital, and expanding its global influence. Since its initial mention, the ETF has increased by 4.45%.

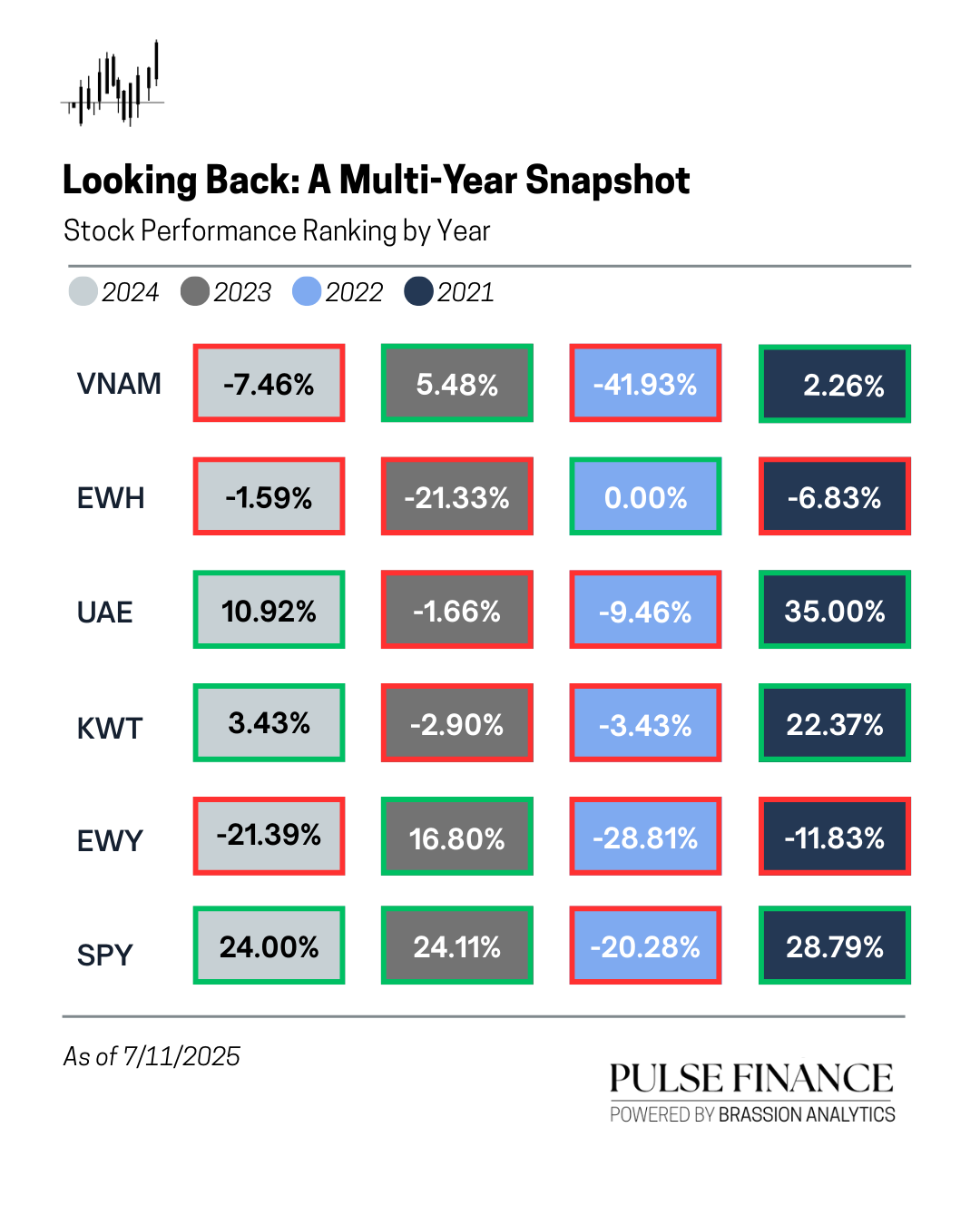

Looking Back: A Multi-Year Snapshot (2024–2021)

What to take away:

Global X FDS MSCI Vietnam ETF (VNAM): Is experiencing a significant turnaround in 2025 following a sharp decline in 2022 and a modest recovery in 2023. Both momentum and sentiment have clearly shifted in its favor.

iShares MSCI Hong Kong ETF (EWH): Longer-term returns reflect the impact of political and economic challenges, yet recent price movements suggest a potential reversal as valuations begin to normalize.

iShares MSCI UAE ETF (UAE): Had an outstanding performance in 2021 and is increasingly recognized as a strategic choice for exposure to the Middle East and North Africa markets. Over the past four years, it has outperformed all its peers with an average increase of 8.70%.

iShares MSCI Kuwait ETF (KWT): With a strong year in 2021 and minimal exposure to global tech volatility, KWT is considered an attractive low beta option.

iShares MSCI South Korea ETF (EWY): Tends to show cyclical volatility but has turned decisively positive in 2025, benefiting from macro tailwinds in the semiconductor and export sectors. However, over the last four years, it has underperformed its peers, with an average decline of 11.31%.

Why This Matters

The increasing popularity of international ETFs indicates a significant change in investor behavior, as capital shifts from the US to global markets that offer more attractive valuations and sector specific advantages. Countries like South Korea and Vietnam are leading the way, benefiting from high demand industries such as semiconductors and manufacturing. Additionally, regions like the UAE are positioning themselves for long-term growth through initiatives like Vision 2031. The message is clear: global diversification is now a strategic necessity rather than an option. For investors looking for alpha in a market where US indices are showing signs of weakness, focusing on global ETFs may provide both growth opportunities and resilience in the upcoming quarters.