Market Pulse: Copper and Critical Materials Show Strength Amid Tariff Fog

Investors pivot toward domestic resource plays in uncertain policy climate

After the tariff drama on Monday sent shockwaves through global markets, Tuesday brought a more measured response as investors reassessed the situation. The S&P 500 and the Dow Jones Industrial Average closed lower, while the Nasdaq managed a slight gain. Beneath the surface, there was a subtle shift towards strategic materials, particularly copper and rare earths, which gained traction. This movement followed news that Trump is proposing a 50% tariff on copper imports, sparking interest in domestic supply and reigniting attention on US-based producers. While analysts are debating the inflationary risks associated with these protectionist policies, the markets currently seem to be adjusting without panic. As macroeconomic noise grows louder, investors are increasingly focused on companies with tangible assets, durable demand, and pricing power in uncertain conditions.

Our Pulse Gauge Indicator revealed significant strength in the metal mining industry, with key players taking the lead. Ivanhoe Electric saw a surge, fueled by optimism regarding its US-based copper projects amidst the tariff speculation. Ferroglobe also experienced solid gains, benefiting from its involvement in silicon and manganese production as investors seek resilient industrial materials. Freeport-McMoRan increased its YTD gains, supported by ongoing demand for copper and its status as a leading global producer. Dakota Gold and MP Materials also showed steady progress, reflecting growing interest in domestic gold reserves and rare earths. These movements emphasize the increasing investor focus on critical materials that hold strategic importance in the current market landscape. Overall, these trends illustrate a market pivot toward resource security and lasting value amid ongoing geopolitical and economic uncertainties.

Market Pulse Action:

S&P 500 decreased 0.07%

Nasdaq increased 0.03%

Dow decreased 0.37%

VIX decreased 5.56%

Top Performers on a Resource Rich Day

What to take away:

Ivanhoe Electric Inc. (IE): Shares surged as investors anticipated long-term demand for copper, driven by increasing discussions about a potential 50% tariff on copper imports. IE’s US based projects could benefit if Trump’s proposed policies are implemented.

Ferroglobe PLC (GSM): With growing trade tensions, Ferroglobe's silicon and manganese production has attracted attention as investors seek industrial players that can withstand tariff impacts.

Freeport-McMoRan Inc. (FCX): As one of the largest copper producers in the world, FCX continues to thrive amid the global push for electrification. The company remains a favored choice among those looking for beneficiaries of potential tariffs under Trump.

Dakota Gold Corp. (DC): Has seen modest gains due to steady accumulation following a significant surge earlier this year. Its gold reserves in Nevada provide a degree of protection from geopolitical risks.

MP Materials Corp. (MP): Rare earth elements are gaining focus due to technology tensions and reshoring trends. MP’s YTD performance highlights sustained institutional interest.

Year-to-Date Check-in

What to take away:

MP Materials Corp. (MP): The nearly doubling in 2025, reflects MP's strategic position in the global rare earths supply chain. It remains one of the biggest winners of the year as support for critical minerals grows across both political parties. Since its initial mention, the stock has increased by 14.58%.

Dakota Gold Corp. (DC): Strong performance highlights the attractiveness of domestic gold reserves, especially in a volatile policy environment.

Ivanhoe Electric Inc. (IE): Investor speculation surrounding US infrastructure developments and favorable commodity trends has fueled ongoing momentum for IE.

Freeport-McMoRan Inc. (FCX): Interest in FCX has surged due to the copper rally, positioning it among the top performers for 2025. Since it was first featured, the stock has increased by 14.16%.

Ferroglobe PLC (GSM): After last year's downturn, GSM's YTD growth reflects stabilizing fundamentals and emerging positive factors.

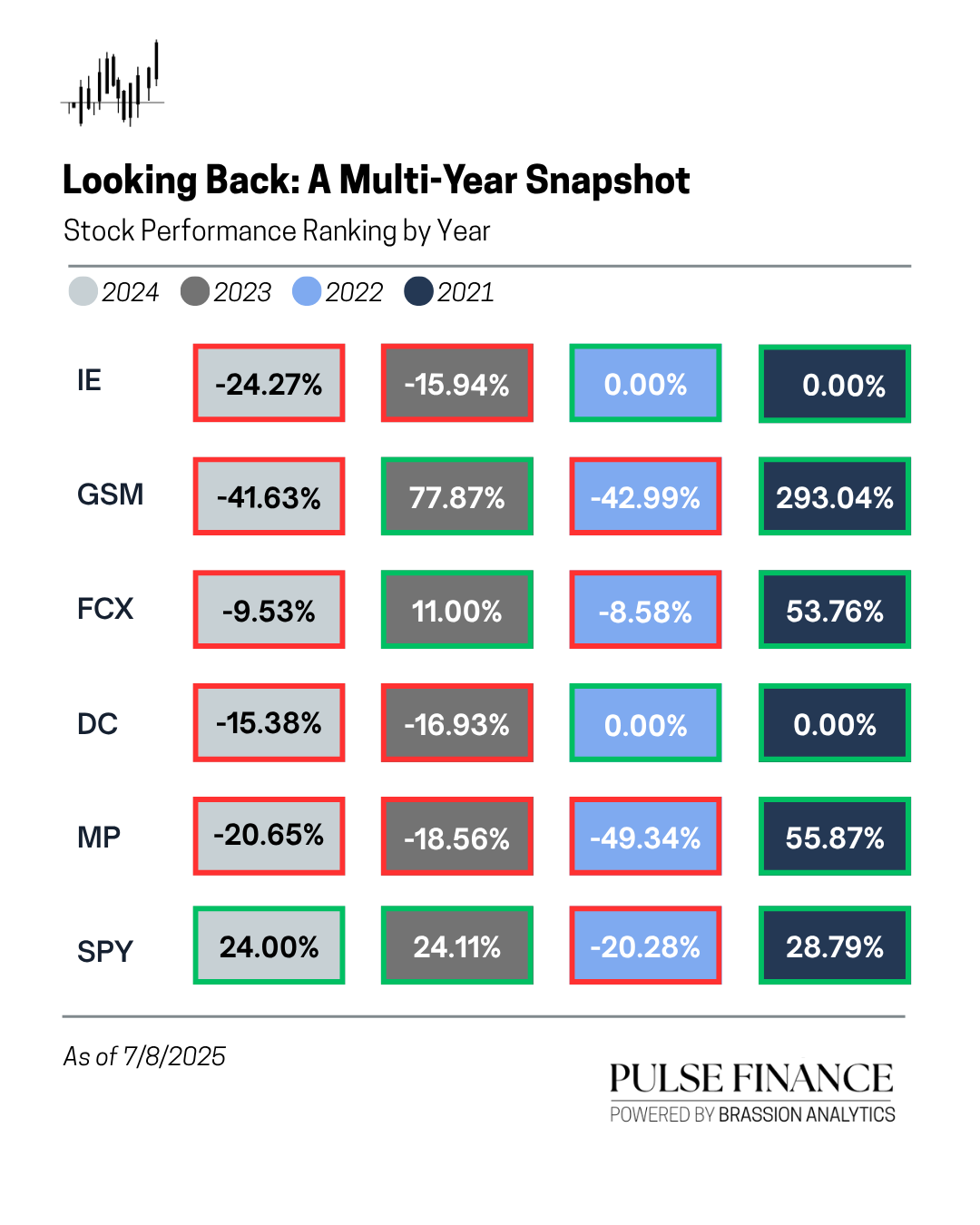

Looking Back: A Multi-Year Snapshot (2024–2021)

What to take away:

MP Materials Corp. (MP): After three years of declines, 2025 has brought a reversal that may suggest a structural shift in investor sentiment around rare earths. However, over the last four years, MP has underperformed its peers, with an average decrease of 8.17%.

Dakota Gold Corp. (DC): The company’s lack of operating history through most of the last cycle limits comparison, but its 2025 performance is attracting attention.

Ivanhoe Electric Inc. (IE): Still early in its lifecycle, IE has recovered from two years of pressure and is gaining traction as a candidate for a copper comeback.

Freeport-McMoRan Inc. (FCX): A strong long-term performer, FCX continues to show how cyclicals can rebound when the macro turns favorable.

Ferroglobe PLC (GSM): GSM’s volatility over the years underscores the importance of timing in industrial metals, yet 2025 shows signs of stabilization. Over the past four years, it has outperformed all its peers, with an average increase of 71.57%.

Why This Matters

A new market narrative is emerging, one that emphasizes resource security, domestic production, and strategic materials. As political discussions around tariffs become more intense, investors are starting to look beyond immediate risks and focus on companies that are well positioned to benefit from structural changes in global supply chains. The increasing interest in copper, rare earth metals, and industrial metals reflects more than just a response to short-term policies. It indicates a growing recognition that real assets, which hold geopolitical significance and can serve as protection against inflation, may play a larger role in investment portfolios moving forward. In a market that is still close to all time highs, this shift toward hard assets suggests that investors are preparing for future uncertainties.